Summary

Technical stakeholders now veto enterprise software deals before procurement even gets involved. But most B2B marketing still focuses on business value alone. The gap? Content that satisfies engineering rigor while driving commercial outcomes. Companies bridging both worlds are winning deals others don't even know they lost.

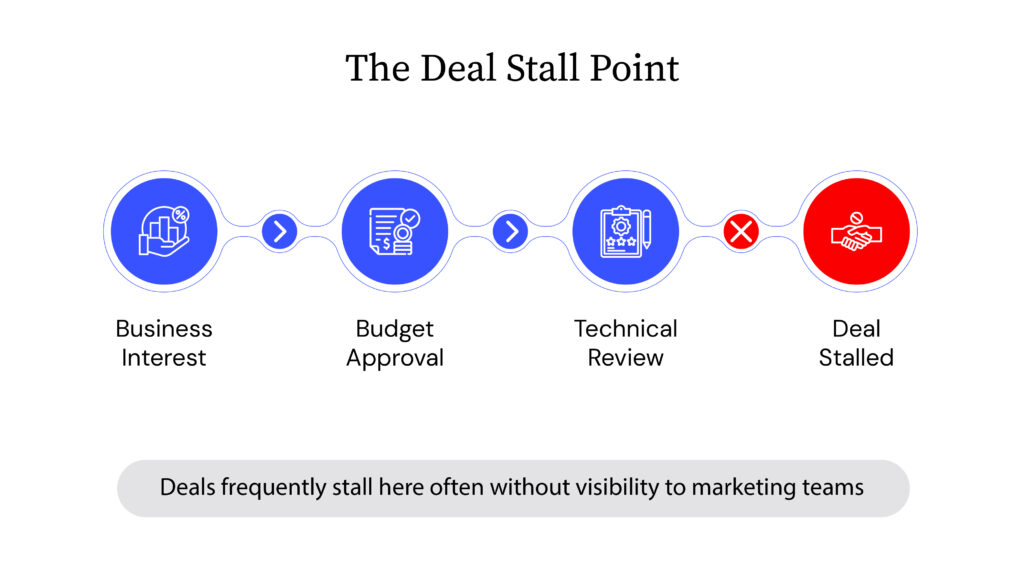

We’ve watched this pattern repeat across tech companies.

Business stakeholders express interest. Finance approves budget. Everything looks promising.

Then engineering reviews the technical documentation.

The deal stalls. Sometimes for weeks. Often permanently. No clear explanation.

The shift in buying power

Something changed in the enterprise software buying process over the past decade.

Technical teams used to implement what business buyers decided. Now they evaluate solutions alongside business stakeholders. They ask different questions. They apply different criteria. And they have formal authority to stop purchases.

We saw this with an enterprise blockchain company. They had Walmart as a client. Strong technology. Multiple product lines solving real supply chain problems. But they struggled to gain traction because their marketing addressed business challenges without providing the technical depth engineers needed to evaluate the platform.

The engineers weren’t being difficult. They needed to understand what they’d be responsible for implementing and maintaining.

Two evaluation tracks, one marketing approach

Business stakeholders ask: Will this solve our problem? What’s the ROI? How quickly can we implement?

Technical stakeholders ask: How does this integrate with existing systems? What happens under load? Where are the failure points? What’s the true complexity of implementation?

Most marketing answers the first set of questions. The second set gets addressed in sales calls, if at all.

For a 5G infrastructure company, this gap was measurable. Their solutions performed well in technical evaluations. Existing clients were satisfied. But they had 5% market awareness while six major competitors dominated 75% of industry conversation.

Technical evaluators simply didn’t know they existed as an option.

What technical evaluation actually involves

Technical stakeholders look for specific signals during vendor evaluation.

Architecture documentation that shows actual system design. Not simplified diagrams for marketing decks, but real technical architecture. Integration specifications. Performance characteristics under different conditions. Security implementation details. Honest documentation of limitations and tradeoffs.

When this material is missing or superficial, technical evaluators draw conclusions about vendor maturity and transparency.

Building credibility with technical audiences

Across clients in 5G infrastructure, blockchain platforms, and analytics tools, we’ve seen consistent patterns in what builds technical credibility:

Public, detailed technical documentation. Make architecture visible. Show data flows, integration patterns, scalability approaches. Include what doesn’t work or requires workarounds. Technical audiences trust transparency over perfection claims.

Implementation honesty in case studies. Include what went wrong during deployments. Actual timelines. Unexpected challenges. How problems got resolved. Technical stakeholders value learning from real implementation experiences.

Accessible security and compliance information. Publish security architecture, compliance frameworks, incident response approaches. Don’t make technical teams request this through sales.

Evidence of active technical support. Responsive community. Updated documentation. Signals that technical problems get addressed by people who understand the technology deeply.

For the 5G company, we created technical content alongside business materials. Deep analysis of implementation challenges. Technical frameworks for provider evaluation. Specific vertical applications with architectural details.

Result: 300% increase in share of voice. They became a reference point in technical discussions. Analysts included them in market assessments. Journalists quoted their technical experts.

Solving for multiple technical audiences

The blockchain company presented an interesting challenge. Two distinct audiences with different technical literacy, requiring enterprise collaboration between business and technical stakeholders throughout the evaluation process.

Enterprise buyers: Technical teams evaluating supply chain solutions, mining compliance systems, logistics platforms. They needed to understand smart contract architecture, integration requirements, data handling approaches. Business and technical stakeholders needed to collaborate on requirements and feasibility assessment.

Developer community: Individual developers and small businesses wanting blockchain capabilities without enterprise software complexity. They needed accessible tutorials, template libraries, clear technical documentation, active community support.

We developed separate content strategies for each. Enterprise content focused on architecture depth and business application. Developer content emphasized accessibility and practical implementation guidance.

Different approaches. Both grounded in technical transparency.

Where technical content belongs

We’ve noticed a pattern. Many companies treat technical content as supplementary material that lives in documentation sites, separate from main marketing.

This creates problems.

Technical stakeholders often evaluate vendors before engaging with sales. They research independently. They want technical information during initial assessment, not after qualifying as a lead.

Companies that surface technical credibility early in the evaluation process see different outcomes. Technical stakeholders find validation for technical claims. They can assess fit before committing time to sales conversations. When they do engage, discussions start from informed positions.

The blockchain company didn’t just educate markets about their technology. They built credibility with both enterprise technical teams and developer communities through accessible, honest technical content.

The trajectory

Technical stakeholder influence in B2B buying continues increasing. Technology complexity grows. Integration criticality intensifies. Security scrutiny expands.

Companies creating content that satisfies both business and technical evaluation criteria are seeing advantages. Shorter evaluation cycles. More qualified pipeline. Technical stakeholders who validate solutions internally rather than raising concerns.

Companies still separating business marketing from technical content are experiencing longer sales cycles and unexplained deal losses during technical review stages.

Key Takeaways:

Technical stakeholders independently evaluate solutions using detailed technical criteria, seeking transparent and honest architecture documentation and real implementation experiences. The enterprise software buying process has fundamentally changed with technical teams gaining formal veto authority. To build credibility, technical content should be integrated into primary marketing efforts rather than being isolated in separate documentation sites, ensuring technical audiences find essential information early in their evaluation process.